Technology of

Sustainable Tomorrow

SUNX is not just another project using blockchain; we have developed our own blockchain and produce our own cutting-edge devices to build a truly sustainable and affordable ecosystem.

Data is Everything

In a world where data is the key to sustainability, SUNX stands apart.We create both the technology and the platform to capture real-world CO₂ data — decentralized, solar-powered, and ready for a global impact.

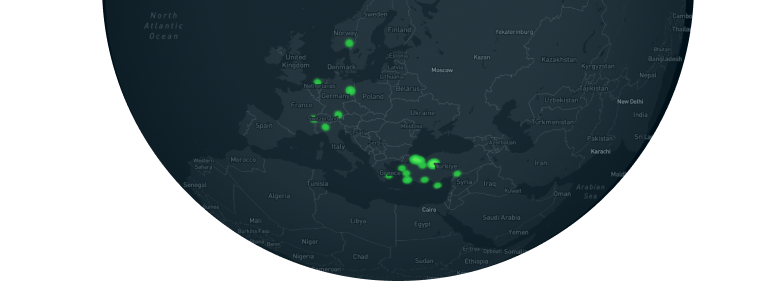

We are Spreading

SUNX technology is already at work across diverse environments. Our solar-powered IoT devices and zero-carbon blockchain are driving real-world sustainability, one location at a time.

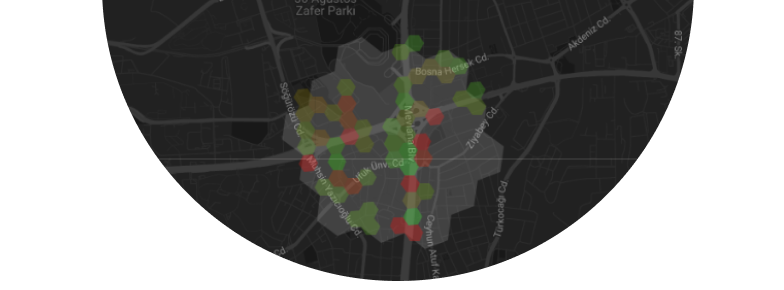

Real Life Cases

Monitor the Environment

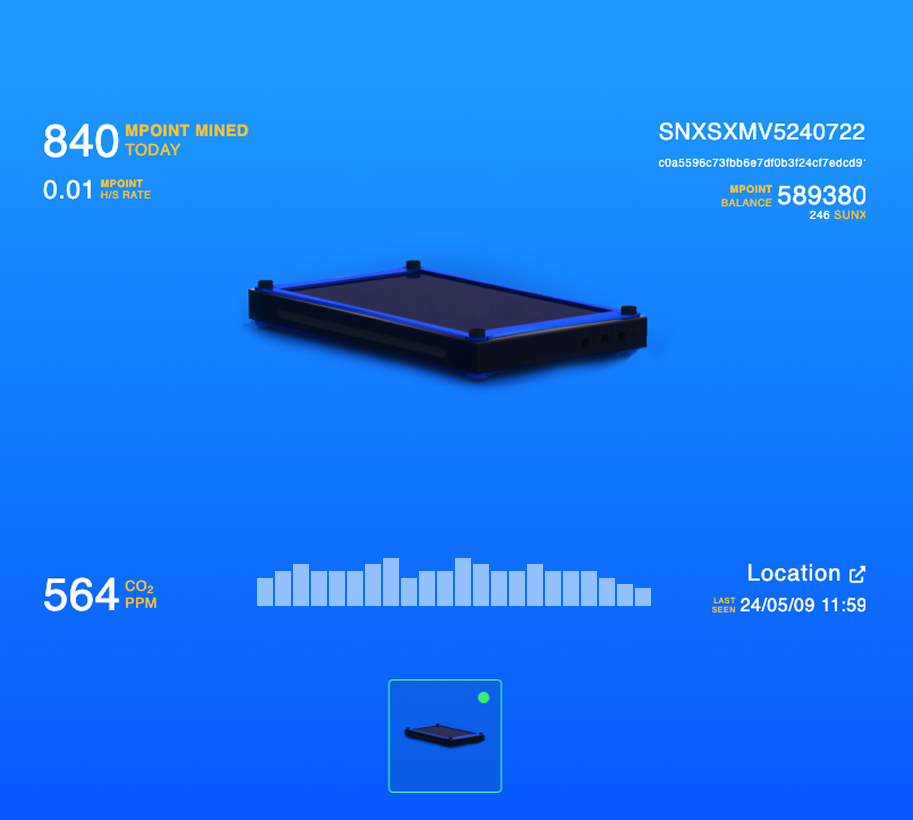

and Get Rewarded

Earn SUNX Coin by simply running an SX Miner or PX Carbostar in your environment. Just power up your device and get rewarded with the world's first zero-carbon emission cryptocurrency.

Start Earning from Your Devices

Smart Alliance

On a Strong Foundation

On a Strong Foundation

The SUNE Foundation is the trusted custodian of all digital assets and the ethical compass behind the SUNX project. Our mission goes beyond infrastructure — we aim to solve real-world sustainability problems by supporting environmental data initiatives, community-driven impact projects, and decentralized innovation for a better future. Through research, partnerships, and technological stewardship, we build a foundation for lasting change.

Where SUNE Foundation Makes a Difference

Global Movement

Local Impact

SUNX isn't bound by borders — our technology and mission adapt to the needs of diverse environments, from urban innovation hubs to rural sustainability initiatives. Every data point, no matter where it comes from, contributes to a transparent and collective climate action system.